How does Vietnam’s cashew industry impact Cambodia ?

Vietnam and Cambodia share a complex economic relationship in the cashew industry, where Vietnam emerges as a global processing powerhouse and Cambodia serves as a crucial raw material supplier. Vietnam has an enormous cashew processing capacity that far exceeds its domestic raw cashew nut production, which creates a significant demand for Cambodian raw cashews. Currently, Cambodia exports over 70% of its raw cashew nuts to Vietnam, establishing a trade relationship that provides Cambodian farmers with a reliable market while allowing Vietnamese processors to meet their substantial international kernel export requirements. However, this relationship also represents an opportunity for Cambodia to potentially develop its own processing capabilities, potentially capturing more value in the global cashew market by moving beyond raw material export to creating processed cashew products. The economic interaction between these two countries highlights the intricate ways neighboring nations can develop interdependent agricultural and trade relationships that benefit both parties while also presenting opportunities for future economic growth and diversification.

The Global Cashew Landscape: Vietnam and Cambodia’s Interconnected Journey

Understanding the Context

Imagine the cashew industry as a complex ecosystem where countries are not just producers, but interconnected players in a global value chain. Vietnam and Cambodia represent a fascinating case study of how regional economic relationships can simultaneously create opportunities and challenges.

Vietnam: The Global Cashew Processing Powerhouse

Processing Capacity and Global Significance

Vietnam stands as a colossus in the global cashew processing industry. With a staggering processing capacity exceeding 1,300,000 metric tons of Raw Cashew Nuts (RCN) annually, the country has positioned itself as the world’s leading exporter of processed cashew kernels. However, this impressive capacity comes with a critical caveat: Vietnam’s domestic RCN production cannot meet its own processing needs.

The Cambodia Connection: A Symbiotic Relationship

This is where Cambodia enters the narrative. Currently, Cambodia exports over 70% of its RCN to Vietnam, creating a symbiotic yet complex economic relationship. For Cambodian farmers, this represents a lifeline—a guaranteed market for their agricultural output.

Economic Implications and Opportunity Costs

The Raw Material Trade

The current trade dynamic reveals a profound economic story:

- Vietnam needs raw materials

- Cambodia has raw materials

- A seemingly perfect match emerges

However, this relationship also represents a significant opportunity cost for Cambodia. By exporting raw cashews instead of processing them domestically, Cambodia effectively leaves substantial value on the table.

Competitive Challenges: Why Vietnam Dominates

- Technological Superiority

Vietnam’s cashew processing industry isn’t just large—it’s technologically sophisticated. Advanced automation and precision technologies enable:

- Higher efficiency

- Consistent quality

- Lower per-unit processing costs

For Cambodian processors, competing against this technological prowess requires strategic investments in skills, technology, and process innovation.

- Cost Structures: A Multilayered Challenge

The cost advantages Vietnam enjoys are multifaceted:

- Lower labor costs

- More reliable electricity infrastructure

- Larger, more skilled labor pool specifically trained in cashew processing

- Economies of scale that reduce per-unit processing expenses

- The RCN Acquisition Dilemma

The Memorandum of Understanding between Vinacas and Cambodia’s Ministry of Agriculture sets an ambitious target: 1 million metric tons of RCN exports to Vietnam by 2028.

While this might seem like a straightforward trade agreement, it carries profound implications:

- Potential increase in RCN prices

- Reduced availability for domestic processors

- Increased competition for raw materials

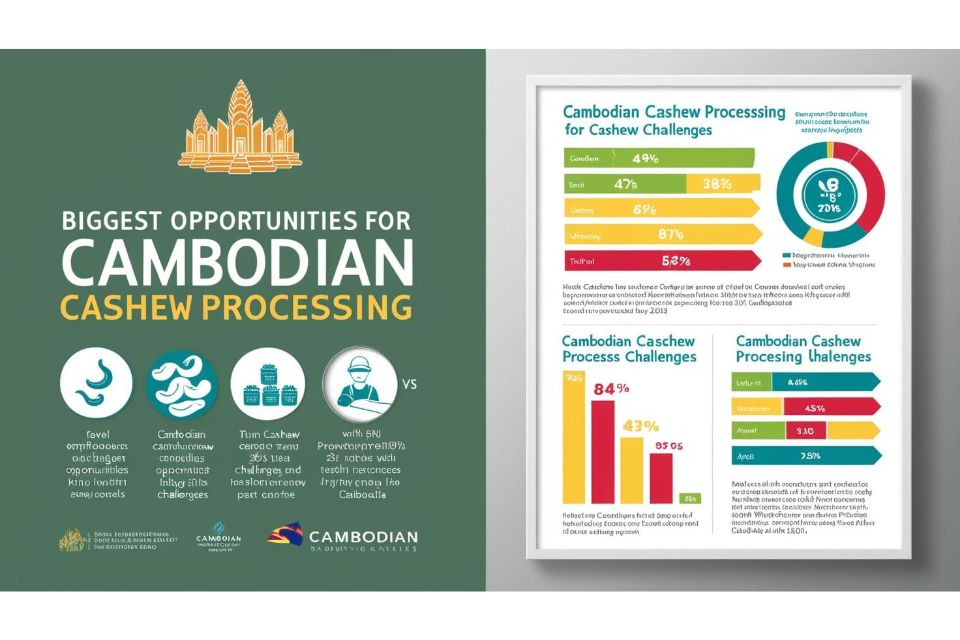

Strategic Pathways for Cambodia

Transforming Challenges into Opportunities

Cambodia isn’t destined to remain a raw material exporter. By focusing on strategic development, the country can reposition itself in the global cashew value chain:

Skill Development

- Create specialized training programs in cashew processing

- Develop vocational pathways focused on agricultural value addition

- Invest in technology transfer and skills upgrades

- Explore partnerships for technological upgrades

- Invest in small-scale, efficient processing technologies

- Focus on quality over quantity

Value Chain Innovation

- Develop niche market strategies

- Focus on high-quality, specialty cashew kernel production

- Explore direct international market access

Policy Support

While tax exemptions are helpful, comprehensive support is crucial:

- Infrastructure development

- Access to affordable capital

- Technology transfer programs

- Market development initiatives

A Transformative Potential

The relationship between Vietnam and Cambodia’s cashew industries is not a story of competition, but of potential transformation. By understanding the complex dynamics, investing strategically, and focusing on unique strengths, Cambodia can evolve from a raw material supplier to a sophisticated, value-added processor.

The journey will require patience, investment, and a holistic approach that goes beyond traditional agricultural export models.

Would you like to explore any specific aspect of this fascinating economic ecosystem in more depth? Each layer of this relationship offers fascinating insights into regional economic development.