Cashew Nut Processing in Cambodia: FAQ

Cashew Nut Processing in Cambodia: FAQ

Is it profitable to establish a cashew nut processing plant in Cambodia?

Yes, establishing a cashew nut processing plant in Cambodia can be profitable. Research indicates a positive return on investment, with a healthy net present value (NPV) and a favorable benefit-cost ratio (B/C ratio). The profitability is driven by factors such as:

- High-quality RCN: Cambodian raw cashew nuts (RCN) are known for their good flavor, leading to high demand in international markets.

- High kernel yield: Cambodia boasts a high kernel outturn ratio (KOR), meaning a higher proportion of usable kernels are extracted from the RCN compared to other producers.

- Tax exemptions: Cambodia offers tax incentives for small and medium enterprises (SMEs), reducing operational costs.

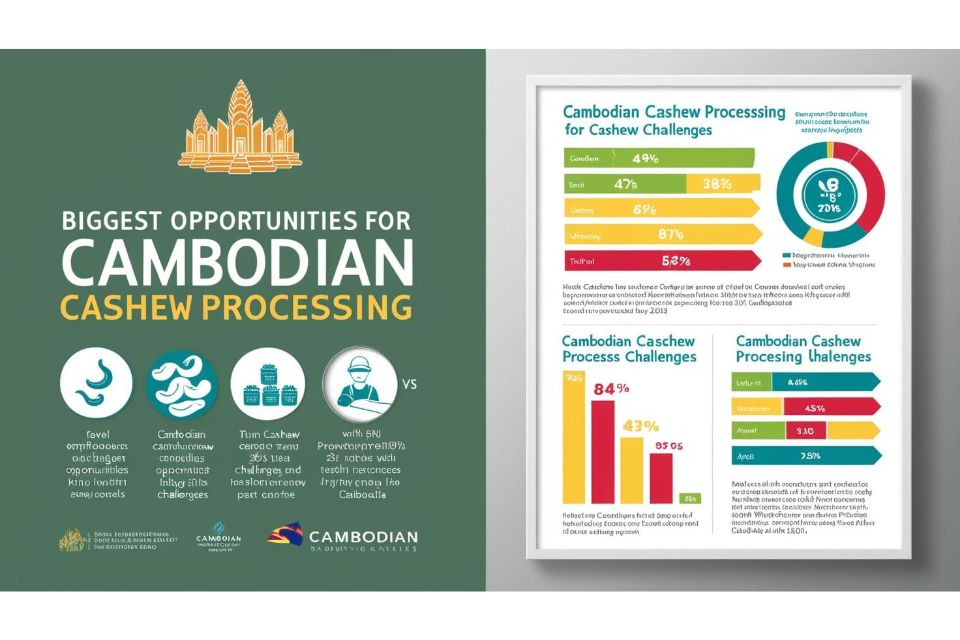

What are the main challenges to consider before investing in cashew processing in Cambodia?

While the potential for profit exists, several challenges must be considered:

- Competition for RCN: Vietnam is a major buyer of Cambodian RCN, potentially increasing prices for processors.

- Skilled labor shortage: Cambodia lacks a skilled labor pool in cashew nut processing, requiring ongoing investment in training.

- High electricity costs and unreliable supply: Electricity costs are high and supply is often unreliable, increasing costs and hindering competitiveness.

- Value chain reconfiguration: Current value chains are geared towards RCN export. Shifting to domestic processing necessitates adjustments and new partnerships.

How does the quality of cashew kernels affect profitability?

The quality of cashew kernels is crucial for profitability. Higher quality, represented by a higher proportion of whole kernels and a higher KOR, leads to:

- Higher prices: Whole kernels command a premium price compared to split kernels.

- Increased demand: High-quality kernels are sought after in international markets, particularly those focused on healthy snacks and ingredients.

Investing in quality control measures along the supply chain and within the processing facility can significantly enhance profitability.

How does the price of RCN impact profitability?

The investment is sensitive to RCN prices. As prices increase, profitability decreases. However, RCN prices typically remain low during the harvesting season due to:

- Farmer needs: Many farmers sell their RCN immediately after harvest to repay loans and lack storage facilities.

- Competition: Competition from other RCN producing countries during the harvest season can keep prices down.

Strategically purchasing RCN during harvest and securing a reliable supply can mitigate price fluctuations.

What are the potential benefits of establishing a domestic cashew processing industry in Cambodia?

Beyond direct profits for the processing firm, a domestic industry can generate:

- Job creation: Processing facilities create employment opportunities, as exemplified by the 23 jobs created in the analyzed project.

- Increased income for farmers: By selling to local processors, farmers can potentially receive better prices than through exporting raw RCN.

- Economic growth: Value addition through processing contributes to overall economic growth and development.

How sensitive is the investment to increases in labor costs?

The investment is not highly sensitive to moderate increases in labor costs. While rising salaries will impact profitability, the study indicates that focusing on quality improvements, even if they involve increased labor costs, can yield net positive returns.

What are the main opportunities for investment in cashew nut processing in Cambodia?

Key opportunities for investment include:

- High-quality Cambodian RCN with good flavor and high KOR.

- Tax exemptions for SMEs during the initial years of operation.

- Growing global demand for cashew kernels, particularly in health-conscious markets.

What are the financial implications of potential short-term price fluctuations?

Processors need to be prepared for potential short-term price fluctuations caused by factors such as:

- Weather volatility impacting RCN supply.

- Pest outbreaks affecting yields.

- Changes in international market dynamics.

Having access to additional capital or financial reserves can help processors navigate these challenges and maintain stability.