Project Report on Cashew Processing in Cambodia – Reference Guide

Comprehensive Investment Prospectus: Cambodia Cashew Processing Venture

Executive Summary

Opportunity Overview:

This investment prospectus presents a compelling opportunity to establish a small-scale cashew nut processing facility in Cambodia cashew producing provinces. This report analysis demonstrates a robust business model with significant potential for sustainable profitability and regional economic impact.

Use this Guide as reference only and general purpose knowledge.

Investment Highlights:

- Projected 20-Year Net Present Value: US$4,286,201.59

- Benefit-Cost Ratio: 1.23:1

- Annual Processing Capacity: 960 Metric Tons of Raw Cashew Nuts

- Strategic Location in Emerging Agricultural Processing Market

Market Context: Cambodia’s Cashew Landscape

Industry Positioning

Cambodia stands at a critical juncture in the global cashew value chain. While traditionally a raw material exporter, the country possesses unique competitive advantages that create an exceptional investment environment:

- Superior Raw Material Quality

- Recognized internationally for exceptional flavor profiles

- Higher Kernel Outturn Ratio (KOR) of 27% compared to regional competitors

- Attractive characteristics for health-conscious global markets

- Governmental Support Mechanisms

- Income tax exemptions for Small and Medium Enterprises (SMEs)

- Policy frameworks encouraging agricultural value addition

- Strategic initiatives to develop domestic processing capabilities

Detailed Cashew Project Specifications

Technical Infrastructure

- Processing Technology: Small-scale automatic cashew nut processing machinery

- Daily Processing Capacity: 3.2 Metric Tons

- Annual Production Potential: 960 Metric Tons

- Key Technological Features:

- Addresses skilled labor limitations

- Mitigates health risks associated with manual processing

- Enables consistent quality control

Investment Cost Breakdown

Capital Expenditure (Total: US$507,603)

Fixed Investment Components:

- Warehouse Construction: US$240,000

- Processing Machinery: US$173,350

- Diesel Generator: US$10,000

- Transportation Vehicle (3-MT Truck): US$30,000

- Initial Staff Training: US$2,000

- Operational Compliance Costs: US$2,920

Working Capital Allocation

- Raw Cashew Nut Inventory: US$48,000

- Operational Reserves: US$2,133

Financial Projections

Revenue Streams

Projected Annual Revenue: US$2,357,568

Composition:

- Whole Cashew Kernel Sales: US$1,944,000

- Split Cashew Kernel Sales: US$388,800

- Cashew Shell By-product Sales: US$24,768

Operational Cost Structure

Annual Operating Expenses: US$1,538,343

Key Cost Categories:

- Raw Material Procurement: US$1,440,000

- Labor Costs: US$48,000

- Utility Expenses: US$37,693

- Additional Operational Expenses: US$12,650

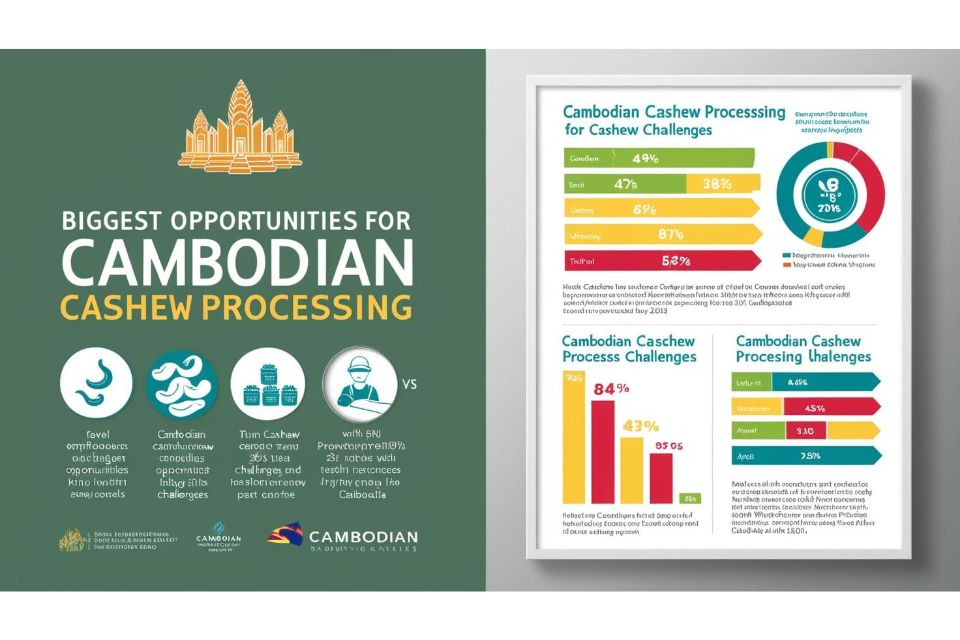

Risk Assessment and Mitigation Strategies

Identified Challenges

- Raw Material Acquisition

- Competitive pressure from Vietnamese buyers

- Potential price volatility

- Mitigation: Long-term farmer contracts, diversified sourcing strategies

- Operational Efficiency

- Limited skilled labor pool

- High electricity costs

- Mitigation: Comprehensive training programs, energy-efficient technologies

Sensitivity Analysis

Critical Vulnerability Points:

- Kernel Prices: Below US$8/kg for whole kernels

- Raw Cashew Nut Prices: Exceeding US$2/kg

- Recommended: Maintain flexible pricing strategies, quality focus

Strategic Recommendations

Competitive Differentiation

- Quality Enhancement

- Invest in processing technology

- Implement rigorous quality control

- Target premium international markets

- Value Chain Integration

- Develop direct farmer relationships

- Create transparent, fair procurement mechanisms

- Invest in farmer training and support programs

- Market Diversification

- Develop both domestic and international market channels

- Explore niche markets (organic, premium health segments)

- Build strong branding around Cambodian cashew quality

Investment Attractiveness Indicators

Positive Signals

- Robust Net Present Value

- Government support mechanisms

- Growing global demand for high-quality cashew kernels

- Potential for significant economic impact

Cautionary Considerations

- Requires active management

- Sensitive to global commodity price fluctuations

- Ongoing investment in skills and technology

Conclusion: A Strategic Agricultural Investment

The proposed cashew processing venture represents more than a business opportunity—it’s a strategic investment in Cambodia’s agricultural transformation. By combining advanced technology, quality focus, and strategic market positioning, investors can participate in a venture with strong financial potential and meaningful economic development impact.

Recommended Next Steps

- Conduct detailed on-site feasibility assessment

- Develop comprehensive business plan

- Engage with local agricultural authorities

- Secure initial capital and technology partnerships